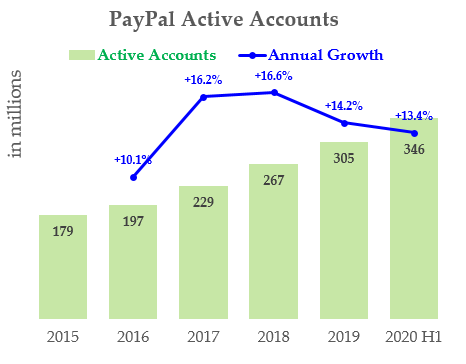

While the PayPal news may indeed be significant for hastening adoption, Bitcoin’s digital scarcity itself is where the asset’s true value is found. The entire max supply of Bitcoin also won’t be fully mined until the year 2140, making the current circulating supply that much more limited. Satoshi Nakamoto is suspected to be deceased, and those 1 million BTC may never be accessed again. With even more BTC lost forever due to forgotten private keys or deceased users, the supply may even smaller than thought.Īs much as 1 million BTC is said to be held by wallets related to the asset’s creator. Wealthy individuals are bound to buy up the lion’s share of the asset, making it even more scarce through demand. Related Reading | Bitcoin Stock-To-Flow Model Updated To Account for Satoshi’s 1 Million BTCīut as we’ve learned from the dollar, wealth is rarely distributed evenly. And if the entire global population of 7.8 billion people all wanted Bitcoin, there’s only enough of the cryptocurrency for 0.0026 BTC to be equally distributed.Ģ1 million BTC distributed equally across just PayPal’s 305 million users alone, would only amount to 0.068 BTC per user.Įven Venmo’s goal of 52 million users by the end of 2020, spread out evenly wouldn’t even make for half a Bitcoin per user. There aren’t enough for the number of millionaires in the world to one 1 BTC each. Although a mechanism exists that unlocks new BTC to incentivize miners to keep the network churning, the max number of Bitcoin will never increase.

Simple Mathematics Highlights The Potential Impact on Bitcoin Supply and Demandīitcoin was designed to be digitally scarce, making the asset a hedge against inflation. The significance of exposing a substantial userbase to Bitcoin and other cryptocurrencies cannot be understated.īut for those that don’t quite understand the impact, comparing these figures to Bitcoin’s maximum supply can be eye-opening.

0 kommentar(er)

0 kommentar(er)